PROTECT YOUR HOME

with strata insurance.

If you’re a lot owner, or unit owner in New South Wales, then getting strata insurance is a requirement for your strata property.

Whether your place is a cosy residence or a bustling business, having the right strata insurance solution is key to safeguarding your property.

A Level Above

Why strata insurance is essential

In accordance with the Strata Schemes Management Act 2015 (NSW), you are required to obtain strata insurance. Strata insurance covers the building and common areas, protecting against damage from events like fire, storms, vandalism, and other natural disasters. Without it, the costs of repairing or rebuilding after such incidents could be financially devastating.

The strata legislation also requires public liability insurance, which protects against injuries or accidents that occur in common areas, such as hallways, gardens, or basement areas. If someone is injured, the insurance can cover legal costs, medical expenses, and compensation claims.

For property owners, strata insurance provides financial protection against unexpected costs. Without it, individual owners could face bills for repairs to the building’s structure or common areas, which would have to be paid for out of pocket or through special levies.

Types of strata insurance

Building Insurance

Keeps shared areas like lobbies and communal spaces safe, covering repairs or rebuilding when damage occurs unexpectedly.

Public Liability Insurance

Protects against legal claims from accidents or injuries in common areas.

Workers' Compensation Insurance

Covers work-related mishaps for employees such as cleaners or maintenance personnel.

Office Bearer’s Liability Insurance

Shields members of the owners corporation from legal claims arising from their decisions.

Catastrophe Insurance

Provides extra cover during natural disasters such as floods or earthquakes.

Machinery Breakdown Insurance

Covers necessary repairs for essential equipment like elevators and HVAC systems.

STRATA INSURANCE FAQs

Choosing the right broker is important. Consider these traits:

- Experience: Seek out a broker who understands strata insurance to ensure compliance with the strata legislation insurance requirements.

- Reputation: Investigate their credentials, read reviews, and check their standing in the insurance industry.

- Customer Service: A reliable broker with strong communication skills can make your insurance journey smooth and hassle-free. They should also provide you adequate time to consider quotations.

- Claims Support: Look for a broker with a strong claims process and adequate resources to manage unexpected claims.

A reputable broker helps you navigate strata insurance, and policy terms while ensuring you get comprehensive cover at a fair price.

Both types of strata insurance have the same categories of coverage but it is important to review the sums insured and terms of the policies for specifies relevant to your strata scheme:

- Residential Strata: Review areas of exclusions in the policy terms which may prevent an insurance claim being accepted and seek advice from an insurance broker on the adequacy of the insured sums.

- Commercial Strata: Look carefully at policy terms, for example some insurance policies can have an exclusion on fit-out work being conducted over $500,000.

An experienced insurance broker can provide guidance to meet your property’s specific needs.

Several myths may confuse owners:

- “Strata insurance covers personal belongings.” No, only common areas are covered; personal items inside apartments require separate contents insurance.

- “Strata insurance covers all types of damage.” Unfortunately, things like wear and tear or poor maintenance or defects aren’t covered. Review the exclusions to avoid surprises.

- “Strata insurance premiums never change.” Premiums can fluctuate based on claim history or changing risks.

By debunking these myths, you can make informed decisions and avoid any unseen gaps in coverage.

The owners corporation is tasked with maintaining the strata insurance cover. Their responsibilities include:

- Securing and Maintaining Insurance: Arranging and renewing policies annually is their duty.

- Managing Premiums: Collecting strata levies to finance insurance fees.

- Claims Coordination: Engaging insurers when a claim arises and ensuring swift repairs.

- Policy Reviews: Regularly reviewing the policy to ensure compliance and coverage adequacy.

The owners corporation plays a pivotal role in all aspects of strata insurance.

Tailored insurance is often required for strata property due to its unique needs:

- Strata Building Insurance: Protects structures and common property from risks like fires or accidental damage.

- Public Liability Insurance: Guards against liabilities for accidents in shared areas.

- Machinery Breakdown Insurance: Covers essential equipment repairs to keep everything running smoothly.

- Office Bearer’s Liability Insurance: Protects the owners corporation from legal issues.

- Disaster Insurance: Provides protection against natural disasters.

Working with a broker ensures a plan that meets your strata scheme’s specific needs.

Despite strata insurance covering common areas, individual owners may need additional protection:

- Contents Insurance: Covers personal items like furniture and electronics from theft or damage.

- Landlord Insurance: Protects rental property owners against tenant-related losses or damage.

- Personal Liability Insurance: Covers claims related to accidents within individual units.

- Income Protection Insurance: Provides financial support if you’re unable to work due to illness or injury.

- Legal Expenses Insurance: Covers costs for legal disputes over ownership or tenancy issues.

These additional covers provide a safety net for both shared and personal property.

Here’s how to handle the claims process if a disaster strikes:

- Notify the owners corporation to start the claims process with the insurer.

- Collect evidence of the incident, such as photos and other proof.

- Submit the claim through the owners corporation to the insurer.

- The insurer assesses the claim to ensure it meets coverage requirements.

- If approved, the insurer arranges repairs or compensation.

- Resolve disputes using the insurer’s dispute resolution process if needed.

Understanding these steps ensures a smoother resolution.

Here are some strategies to help reduce your strata insurance premiums:

- Risk Management: Perform regular maintenance and safety checks to minimise risks.

- Increase Deductibles: Raising deductibles can lower premiums, but ensure they’re manageable.

- Review Coverage Limits: Avoid over-insuring; make sure your coverage matches the property’s true value.

- Security Enhancements: Installing security systems can reduce risks from theft or vandalism.

- Compare Quotes: Regularly compare quotes to ensure you’re getting a good deal.

These tactics, alongside choosing the right broker, help keep your strata insurance costs in check.

Contents insurance is crucial for protecting personal items within individual units. Key benefits include:

- Protection for Personal Items: Covers furniture and electronics against theft or damage.

- Financial Security: Reduces the burden of replacing personal belongings.

- Liability Protection: Covers claims for accidents in your unit.

- Peace of Mind: Ensures your possessions are protected, allowing you to focus on other matters.

Combining contents insurance with strata insurance guarantees full protection for both personal and communal property.

- Risk Management: Perform regular maintenance and safety checks to minimise risks.

- Increase Deductibles: Raising deductibles can lower premiums, but ensure they’re manageable.

- Review Coverage Limits: Avoid over-insuring; make sure your coverage matches the property’s true value.

- Security Enhancements: Installing security systems can reduce risks from theft or vandalism.

- Compare Quotes: Regularly compare quotes to ensure you’re getting a good deal.

These tactics, alongside choosing the right broker, help keep your strata insurance costs in check.

Public liability insurance protects the owners corporation from legal claims due to accidents in shared spaces. This insurance:

- Protects Against Legal Claims: Covers legal fees and compensation for accidents in common areas.

- Mitigates Risk: Reduces financial fallout from incidents in areas like lobbies or gyms.

- Compliance: Public liability cover is mandatory for strata schemes in NSW.

Proper public liability insurance is vital for safeguarding both the corporation and individual owners.

- Risk Management: Perform regular maintenance and safety checks to minimise risks.

- Increase Deductibles: Raising deductibles can lower premiums, but ensure they’re manageable.

- Review Coverage Limits: Avoid over-insuring; make sure your coverage matches the property’s true value.

- Security Enhancements: Installing security systems can reduce risks from theft or vandalism.

- Compare Quotes: Regularly compare quotes to ensure you’re getting a good deal.

These tactics, alongside choosing the right broker, help keep your strata insurance costs in check.

A strata manager plays an important role in managing the complex’s insurance matters, with tasks such as:

- Policy Renewal: Ensuring the insurance policy is reviewed and renewed annually.

- Claims Management: Acting as the main point of contact for handling insurance claims.

- Risk Management: Identifying potential risks and implementing measures to mitigate them.

Strata managers streamline the insurance process, safeguarding both the property and its occupants.

- Mitigates Risk: Uses their experience to ensure there has been adequate disclosure and appropriate coverage.

- Compliance: Oversees compliance with the Strata Schemes Management Act 2015 (NSW).

- Risk Management: Perform regular maintenance and safety checks to minimise risks in conjunction with building management.

- Compare Quotes: Regularly compare quotes to ensure you’re getting a good deal.

The right strata manager and insurance broker, help keep your property protected.

An uncompromising level of service. All for a more inclusive fee.

Explore our portfolio

Services that maximises asset value

Independent onsite management

- Support to help enhance the lifecycle of assets

- To improve the appearance, amenities and functionality of buildings

- Ensure compliance with strata schemes development regulations

Administrative and compliance specialists

- Management of day-to-day building maintenance matters

- Improve service contractor productivity to maximise efficiency

Less buildings.

More attention.

- Each one of our strata managers maintains fewer properties than the industry average

- Allowing for a more focused, personalised service

- Expect your dedicated strata manager to respond directly within one business day

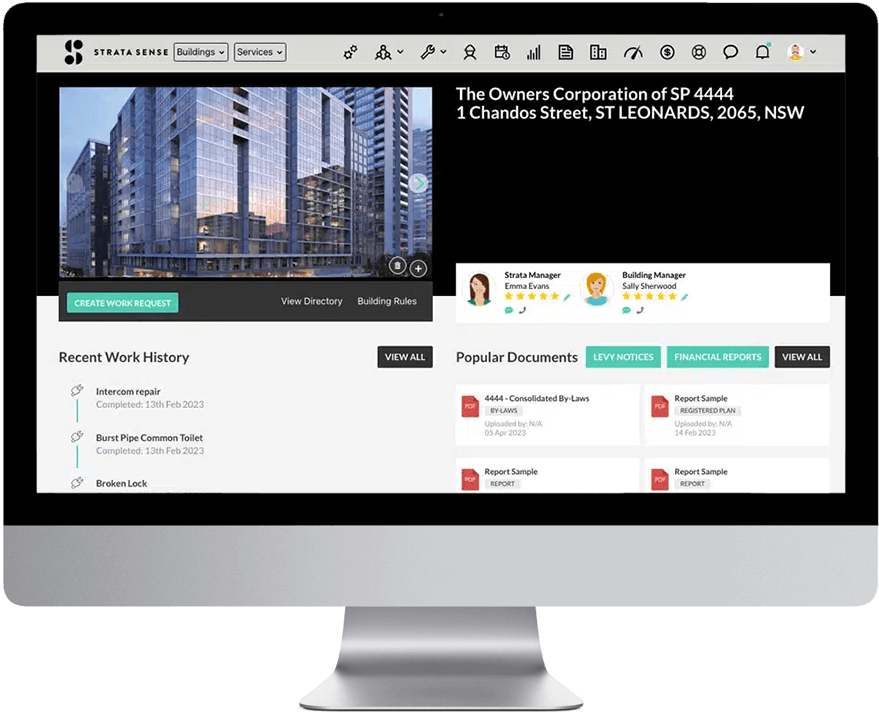

Tech-led solutions at your fingertips

Access our intuitive cloud platform

With Strata Connect, enjoy ease, efficiency and secure financial transactions for your scheme, owner levy account, and strata records, 24/7.

Automate accounts payable

Our multi-tiered approval process makes approving your supplier invoices simple and seamless, ensuring your strata management runs smoothly.

Easy-to-use collaboration tool

Enhance your strata committee’s online communication and facilitate quick decisions to streamline the management of your strata property.

Protect your building's funds

Secure your building’s funds easily with our term deposit interface, making financial management simpler.

Hear from our happy clients

Keep your property safe with strata insurance

Strata insurance is a crucial element of any strata scheme or community estate in New South Wales. By regularly assessing your policy and collaborating with experienced insurance brokers and Strata Sense, we can help you secure the coverage that perfectly suits the specific needs of your strata or community.